Ira mandatory withdrawal calculator

If you consolidate the money into your IRA then the regular RMD rules apply. Thats because on November 6 the IRS released new life expectancy tables that are used to calculate RMDs.

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

E-Filing - Last Name Suffix ie.

. You can look forward to somewhat smaller required minimum distributions RMDs from your IRA and company retirement savings plan beginning in 2022. And is based on the tax brackets of 2021 and 2022. It is mainly intended for residents of the US.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. To make paperwork easier you can also have the taxes withheld from your distribution. RMDs are waived for 2020 and.

If the distribution shown on Form 1099-R is from your IRA SEP IRA or SIMPLE IRA the small box in box 7 labeled IRASEPSIMPLE should be marked with an X If code J P or S appears on your Form 1099-R you are probably subject to a penalty or additional tax. The term rollover is used when an account holder moves money between two different kinds of retirement plans. Should you accept an early retirement offer.

Understand the different distribution requirements for Traditional IRAs and Roth IRAs. A 401k to a traditional IRA or SEP IRA for instance or a traditional IRA to an SEP IRA. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Workers with traditional IRAs and 401ks both face the same reality when it comes to taking mandatory distributions. It is named after subsection 401k in the Internal Revenue Code which was made possible by the Revenue Act of 1978. If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA.

You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income. Traditional IRA calculator. With tax benefits that are mainly available through an employer.

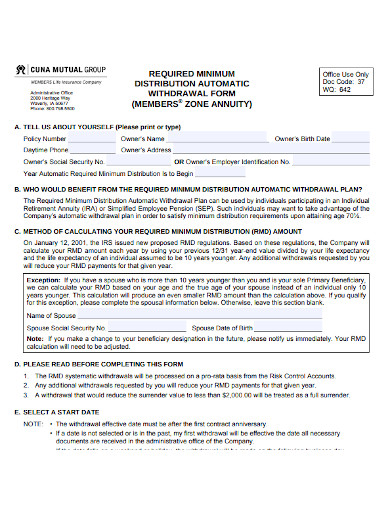

RMDs are mandatory minimum yearly withdrawals that generally must be taken starting in the year the IRA account holder turns age 70 12 upon retirement or at death. Get the facts about Inherited IRA withdrawal rules and distributions. Only Roth IRAs offer tax-free withdrawals.

RMDs must be taken out of tax-deferred retirement accounts including. A Mandatory State Income Tax Withholding When Federal Income Tax is Withheld. A 401k is a form of retirement savings plan in the US.

If electing a total distribution. Show All Help Topics. Income Limits There are income thresholds that prevent many people.

Delay Required Mandatory Distributions. Estimated Tax Payments - Electronic Funds Withdrawal. If you withdraw money before age 59½ you will have to pay income tax and even a 10 penalty.

Finally beyond what you can withdraw from your IRA you might also want to keep in mind how much it really makes sense take out. How to take required minimum distributions from IRA accounts starting at age 70 12. More details on retirement savings withdrawal and COVID-19.

The RMD rules are different for each choice so consider your options carefully. When planning your IRA withdrawal. The CARES Act exempts CRDs from the 20 mandatory withholding that normally applies to certain retirement plan distributions.

For instance many retirees use the 4 rule to determine income. The regular 10 early withdrawal penalty was waived for COVID-related distributions CRDs made between January 1 and December 31 2020. Required Minimum Distributions RMDs are mandatory and you have the option to postpone distributions until the later of.

Lifetime Income Illustration Tool. Use our Beneficiary RMD calculator This tax information. Even though they sound the same a saver cant move funds from a traditional IRA to a Roth IRA without doing a Roth conversion.

Rules vary depending on whether you inherit an IRA from a spouse or non-spouse. A normal distribution is a penalty-free taxable withdrawal. The IRS requires that you begin taking distributions by April 1 of the year following.

The ability to forgo mandatory withdrawals in retirement can be a big advantage with a Roth IRA. Change My Password in My Account. Or you can use a calculator like this one from T.

The income tax was paid when the money was deposited. Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. Form 1099-B - Traders in Securities.

Transfer assets between TD Ameritrade accounts. Roth individual retirement accounts IRAs are powerful tools for building tax-free savings in retirement. If you retired at age 66 with 300000 in your IRA needed 50000 a year to support your retirement lifestyle and received 25000 in income from.

IRA distribution rules vary. Use this calculator to determine your required minimum distributions RMD from a traditional IRAThe SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July 1. Jr Sr Third III Form W-4 - Exemption From Withholding.

Mandatory State Disability and Unemployment Insurance Contributions. The new tables are not effective until 2022. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you.

Move the money into your own IRA. Rowe Price to estimate your distribution you must take a minimum amount but you can always take out more. Contribution and Eligibility Calculator.

Rolling over your IRA to a 401k and giving up some control may better fit your needs as an investor. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. If youve got one already or plan to open one soon use our Roth IRA calculator to see.

How to Contact IRS. NONE Any nationwide withdrawal fees incurred from using another banks ATM will be. Retirement Income Solutions.

You Make These Required Minimum Distribution Mistakes Too Plootus

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Required Minimum Distribution Calculator Estimate The Minimum Amount

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Ira Withdrawal Calculator Hotsell 59 Off Www Alforja Cat

Rmd Calculator Required Minimum Distributions Calculator

How To Calculate Rmds Forbes Advisor

Okauyxe80u81 M

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com