Traditional 401k to roth 401k conversion tax calculator

Colorful interactive simply The Best Financial Calculators. 401 k Rollover Calculator.

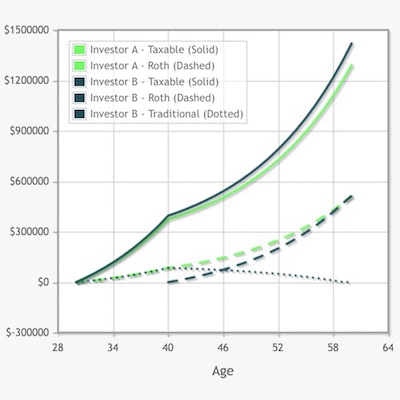

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

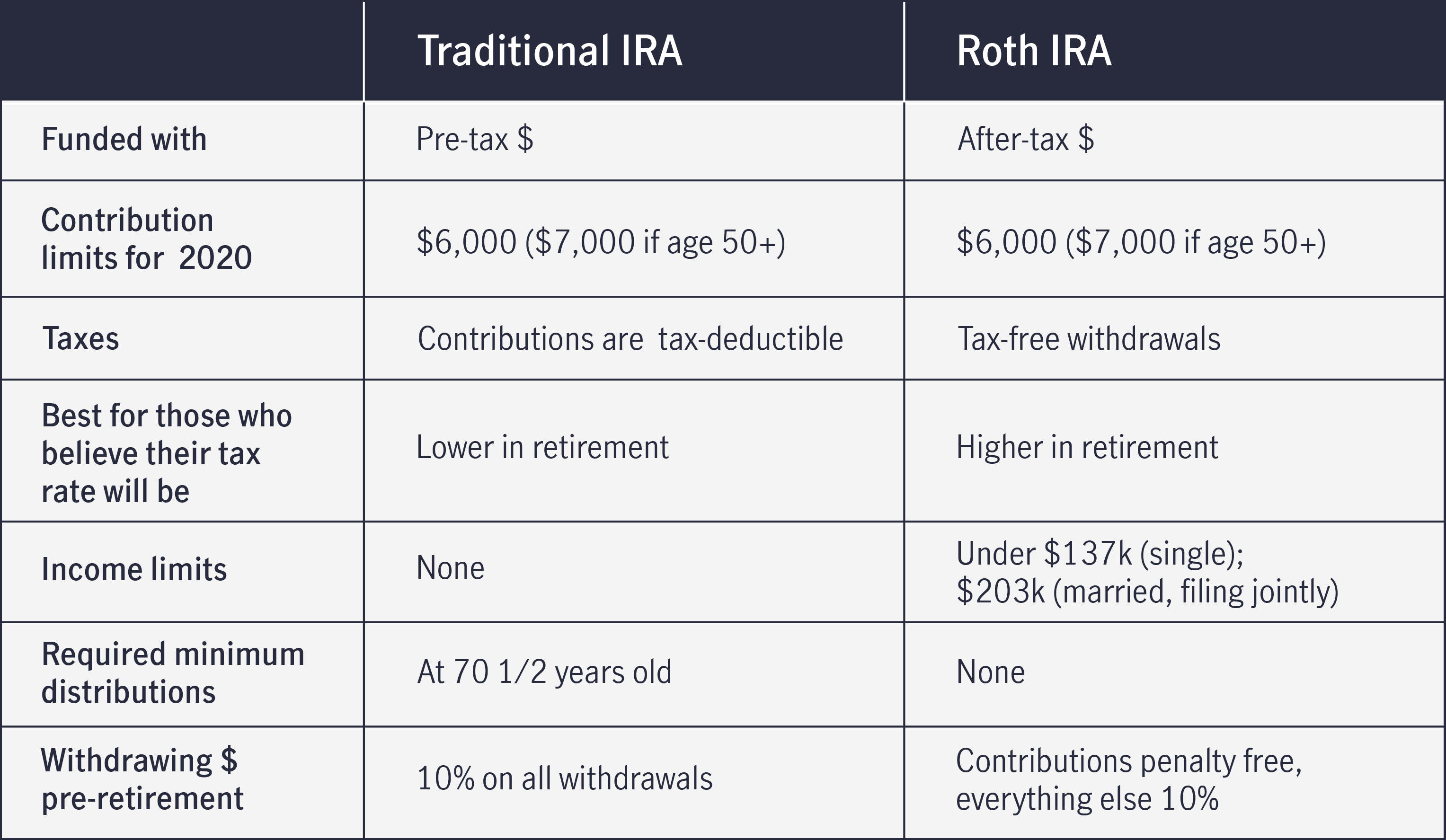

Roth IRA is a great way for clients to create tax-free income from their retirement assets.

. Traditional or Rollover Your 401k Today. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Use the tool to compare estimated taxes when you do. Years until you retire. Roth Retirement Savings Plan Modeler.

With the passage of the American Tax Relief Act any 401k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401k balances to an after-tax. If you are thinking about rolling over and are not sure what option is most financially beneficial we can help you. Roth Conversion Calculator Methodology General Context.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Ad Open an IRA Explore Roth vs.

Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert.

Youre going to have to pay taxes on that money. Traditional or Rollover Your 401k Today. The contribution limits on a Roth 401 k are the same as those for a traditional 401 k.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Your IRA could decrease 2138 with a Roth.

19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Roth 401 k Conversion Calculator.

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement. Thats because the tax benefits of a Roth account are difficult to capture fully with the traditional rule of thumbor even when with the more sophisticated BETR calculation. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

Protect Yourself From Inflation. Traditional vs Roth Calculator. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. 2022 Roth Conversion Calculator. The main drawback of converting a traditional 401k into a Roth 401k is the tax bill that comes with making the switch.

For some investors this could prove. Make a Thoughtful Decision For Your Retirement. The plan offers an option to convert the traditional dollars.

Ad Open an IRA Explore Roth vs. 401k IRA Rollover Calculator. Make a Thoughtful Decision For Your Retirement.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. This calculator can help you make informed decisions about performing a Roth conversion in 2022. This calculator will analyze your information and.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. Whether you participate in a 401 k 403 b or 457 b program the. 10 Best Lenders to Rollover Your 401K into Gold IRA.

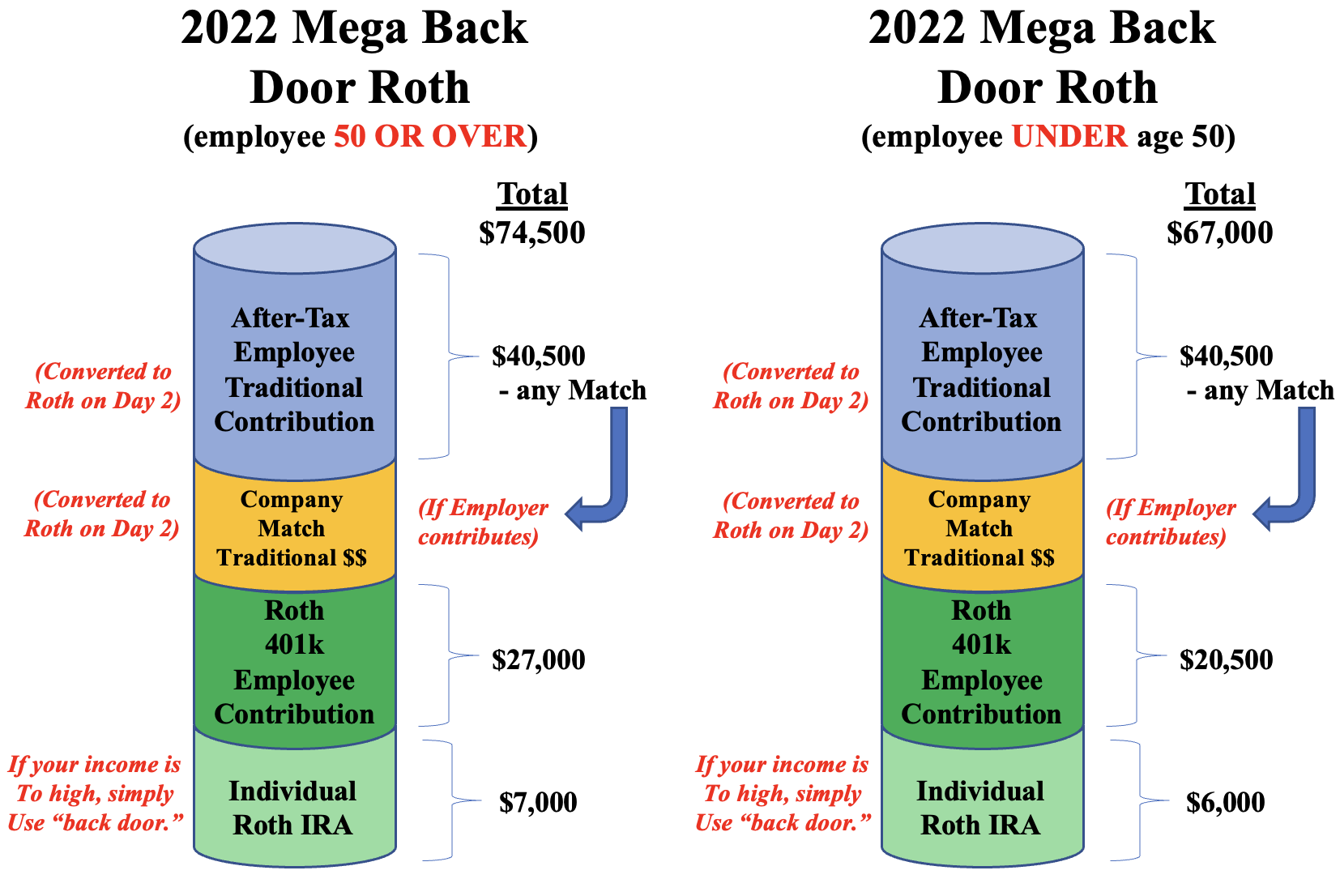

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. I have a Roth 401k but only my contributions go in as Roth and my employer match goes in as traditional dollars.

Mega Backdoor Roth Bogleheads

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Roth Conversion Q A Fidelity

Comparing Traditional Iras Vs Roth Iras John Hancock

Traditional Vs Roth Ira Calculator

Pennies And The Backdoor Roth Ira The White Coat Investor Investing Personal Finance For Doctors Roth Ira Ira White Coat Investor

The Magic Of The Mega Backdoor Roth Mark J Kohler

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Roth 401k Roth Vs Traditional 401k Fidelity

Net Worth Scenario Tool Positive Numbers Negative Numbers Net Worth

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal